are funeral expenses tax deductible in california

Appeared first on SmartAsset Blog. While individuals cannot deduct funeral expenses eligible estates may.

Are Funeral Expenses Tax Deductible

Funeral expenses are not tax deductible because they are not qualified medical expenses.

. Unfortunately funeral expenses are not tax-deductible for individual taxpayers. We do not conform to all federal itemized deductions. California Health Safety Code 102775 2018.

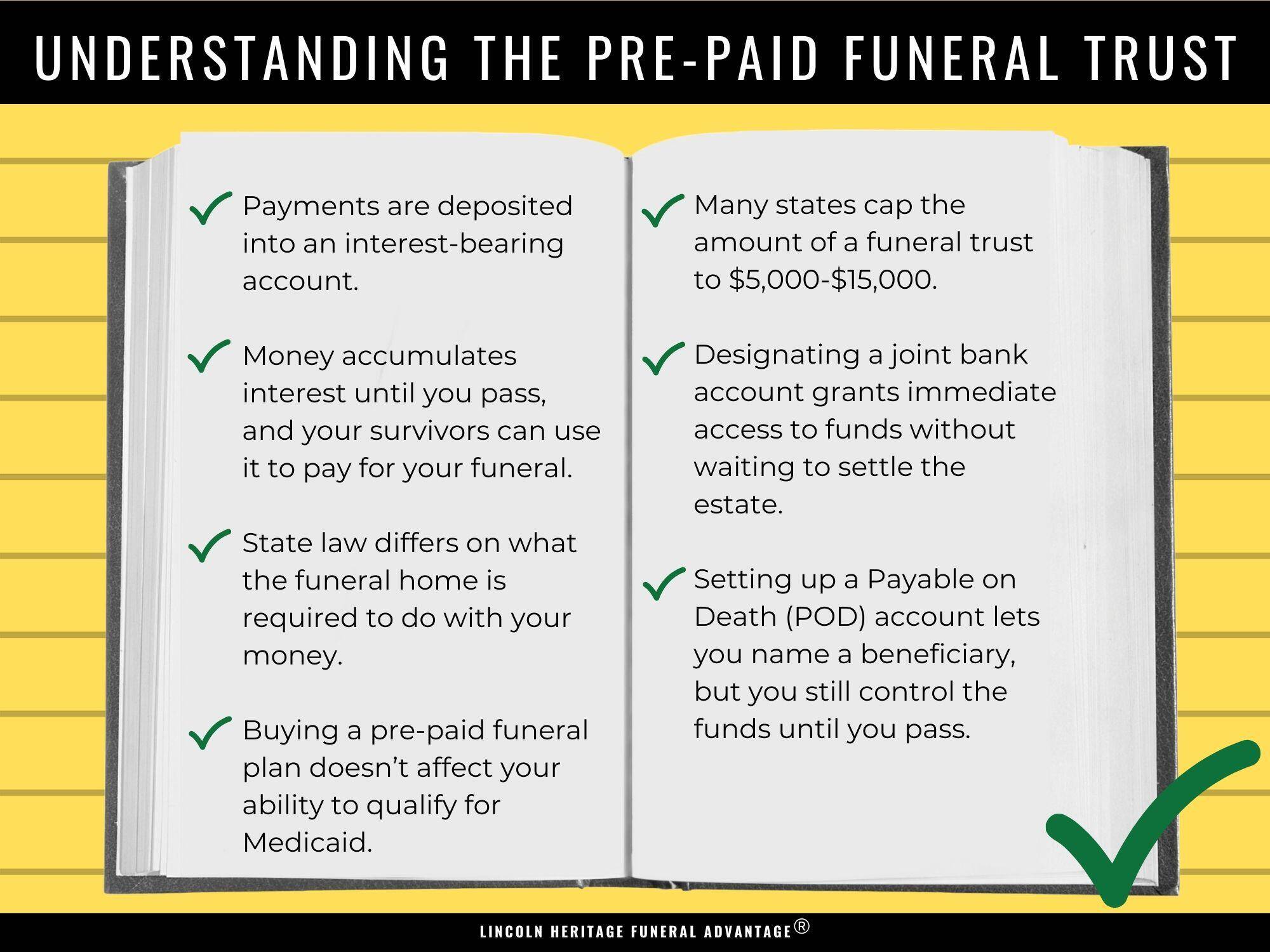

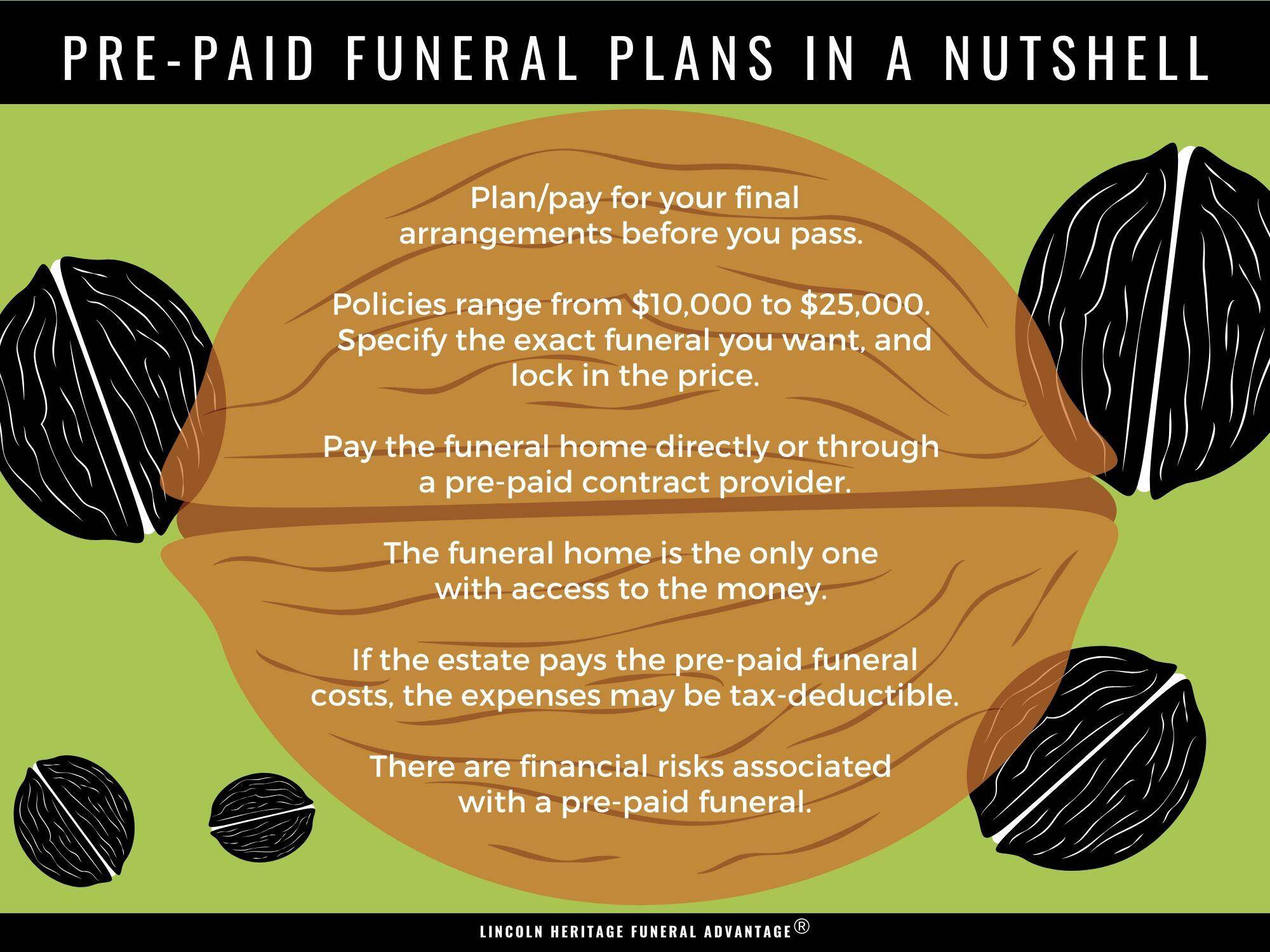

This includes government payments such as Social Security or Veterans Affairs death benefits. The IRS says that if the estate pays the funeral costs such as when using pre-paid plan the estate can use the expenses against its taxes as a deduction. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person.

Its 117 million at the federal level as of 2021 while its only 1 million in Oregon. Itemized deductions are expenses that you can claim on your tax return. According to IRS regulations most individuals will not qualify to claim a deduction for these expenses unless they paid for the funeral out of the funds of an estate.

However they might be for some estates at the state level. State and local taxes real estate tax mortgage interest and charitable contributions. IRS rules dictate that all estates worth more than 1158 million in the 2020 tax year are required to pay federal taxes at which point they can take advantage of tax deductions on the funeral expenses of a loved one.

They can decrease your taxable income. If the estate received the death benefit see. The IRS deducts qualified medical expenses.

It can obviously benefit an estate to claim as many allowable deductions as possible to whittle away at net value and possibly dodge this tax particularly when the estate is nudging up against passing over the exemption threshold. Individual taxpayers cannot deduct funeral expenses on their tax return. On home purchases up to 750000.

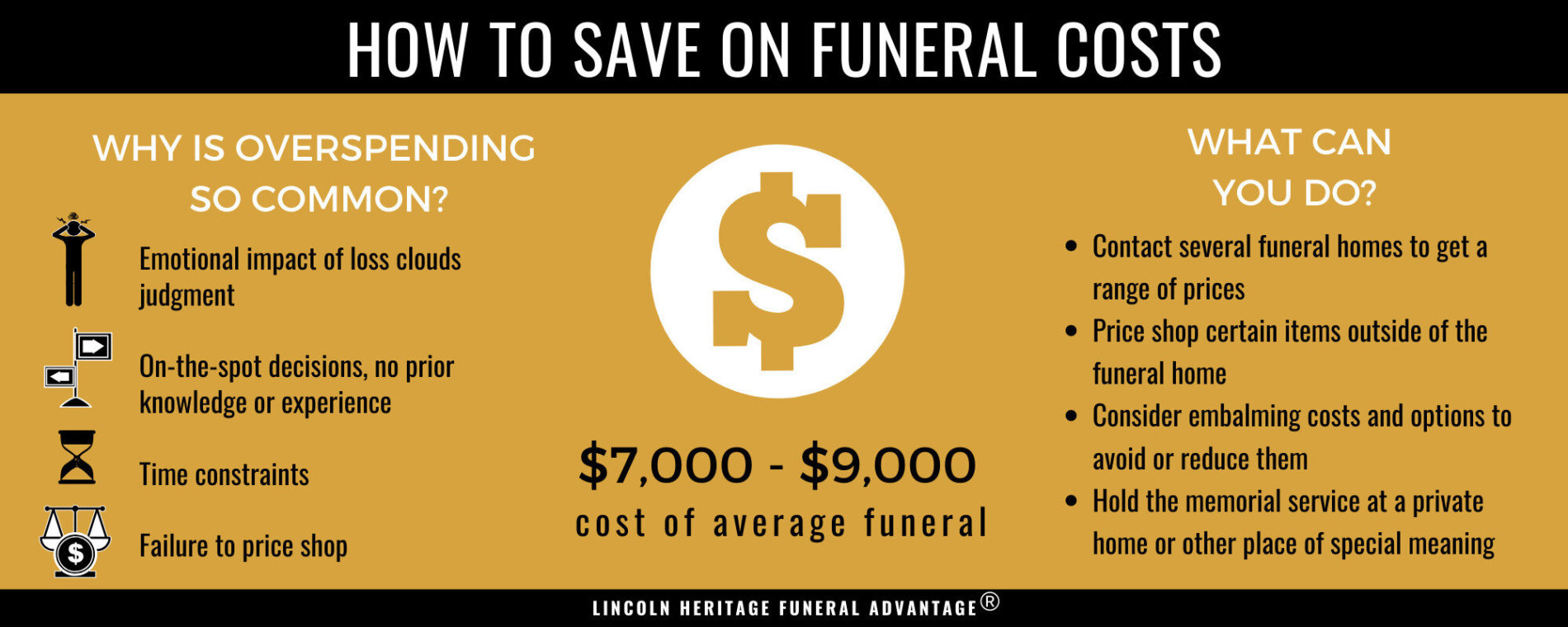

Only the estates payments can be written off. The ability to deduct funeral expenses on your tax returns depends on who paid for the funeral expenses. While these events are a good way to gather family and friends to honor the deceased funerals can be.

You do not qualify to claim the standard deduction. While funeral costs paid by friends family or even paid from the deceased individuals account are not deductible from your annual taxes the estate of your loved one can take a deduction on these costs. Up to 25 cash back If you will not be using a funeral director you must complete and file the death certificate yourself.

Basic Service Fee of the funeral director. If someone takes a flight then the amount of money paid for the tickets cannot be written off because travel expenses are not tax-deductible. The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases.

The taxes are not deductible as an individual only as an estate. Conditions for Cremation Tax Deductibility. Qualified medical expenses include.

The board gave preliminary approval last week to new tax rules about. Funeral expenses are not tax deductible because they are not qualified medical expenses. This means that you cannot deduct the cost of a funeral from your individual tax returns.

The 1040 tax form is the individual income tax form and funeral costs do not qualify as an individual deduction. If theyre paid for by friends family or even the departed individuals account they will not be deductible no individual deductions are. A death benefit is income of either the estate or the beneficiary who receives it.

If an insurance policy covered the costs then the funeral expenses cannot be written off either. Deduction CA allowable amount Federal allowable amount. Funeral Costs Paid by the Estate Are Tax Deductible.

Continue reading The post Are Funeral Expenses Tax Deductible. The IRS deducts qualified medical expenses. In short these expenses are not eligible to be claimed on a 1040 tax form.

Funeral expenses are not tax deductible because they are not qualified medical expenses. Up to 10000 of the total of all death benefits paid other than CPP or QPP death benefits is not taxable. If the estate was reimbursed for any of the funeral costs you must deduct the reimbursement from your total expenses before claiming them on Form 706.

The IRS does not levy taxes on most estates so only the most prosperous can benefit from tax deductions on their funeral expenses. So the state Board of Equalization which interprets tax law wants to make sure California is getting its 825 percent cut. According to the IRS funeral expenses including cremation may be tax deductible if they are covered by the deceased persons estate.

Accounting for reimbursed expenses. Call Final Expense Direct at 1-877-674-0236 if you have. California law requires you to file the death certificate with the local registrar of births and deaths within eight calendar days of the death and before you dispose of the remains.

These expenses may include. Not all estates are large enough to qualify to be taxed. While the irs allows deductions for medical expenses funeral costs are not included.

In order for funeral expenses to be deductible you would need to have paid for the funeral expenses from the estates funds that you are in charge of settling. June 3 2019 1228 PM. Funeral expenses - If you paid for funeral expenses during the tax year you may wonder whether you can deduct these costs on your federal income tax return.

No never can funeral expenses be claimed on taxes as a deduction. Such reimbursements are not eligible for a deduction. Placement of the cremains in a cremation urn.

Unfortunately funeral expenses arent tax-deductible for most people. If the beneficiary received the death benefit see line 13000 in the Federal Income Tax and Benefit Guide. When it comes to funeral costs themselves including burial and other important areas the determining factor in whether tax deductions are available is the source of payment for these costs.

When a loved one passes away most families hold a funeral to mourn remember the deceaseds life and pay last respects. To claim medical. Medical and dental expenses.

If the deceaseds state is. Deductible medical expenses may include but are not limited to the following.

Are Funeral Expenses Tax Deductible

Are Funeral Expenses Deductible The Official Blog Of Taxslayer

How Prepaid Funeral Plans Work Costs Expenses Pros Cons

Are Funeral Expenses Tax Deductible Funeralocity

Are Funeral Expenses Tax Deductible Funeralocity

Are Funeral Expenses Tax Deductible

Top Organizations That Help With Funeral Expenses

Tax Deductions For Funeral Expenses Turbotax Tax Tips Videos

Are Probate Fees And Funeral Expenses Tax Deductible Ez Probate